Redefining the Purpose of Saving

For years, standard monetary recommendations has leaned greatly on the principles of thriftiness, delayed satisfaction, and aggressive saving. From removing morning coffee to giving up trips, the message has been loud and clear: conserve now, take pleasure in later. However as social worths change and individuals reassess what financial wellness really indicates, a softer, more mindful technique to cash is acquiring grip. This is the significance of soft saving-- an emerging mindset that concentrates less on stockpiling cash and more on straightening monetary choices with a purposeful, joyous life.

Soft saving doesn't mean abandoning duty. It's not about neglecting your future or investing carelessly. Rather, it's concerning equilibrium. It's concerning recognizing that life is happening now, and your cash needs to sustain your joy, not simply your pension.

The Emotional Side of Money

Cash is usually considered as a numbers video game, but the method we earn, invest, and conserve is deeply emotional. From childhood years experiences to societal stress, our economic practices are formed by greater than logic. Aggressive conserving approaches, while reliable on paper, can often fuel stress and anxiety, regret, and a persistent fear of "not having enough."

Soft conserving welcomes us to take into consideration just how we feel about our economic selections. Are you avoiding dinner with pals because you're attempting to stay with a rigid financial savings plan? Are you delaying that journey you've dreamed concerning for many years because it doesn't appear "accountable?" Soft conserving difficulties these stories by asking: what's the psychological expense of extreme conserving?

Why Millennials and Gen Z Are Shifting Gears

The newer generations aren't necessarily gaining a lot more, yet they are reimagining what riches resembles. After seeing economic economic downturns, real estate crises, and currently browsing post-pandemic realities, younger people are examining the knowledge of putting off happiness for a later day that isn't guaranteed.

They're selecting experiences over properties. They're prioritizing mental health and wellness, adaptable job, and everyday enjoyments. And they're doing it while still preserving a feeling of monetary obligation-- simply on their own terms. This shift has prompted more individuals to reevaluate what they actually want from their financial journey: comfort, not excellence.

Producing a Personal Framework for Soft Saving

To welcome soft financial savings, beginning by recognizing your core worths. What brings you pleasure? What expenditures truly improve your life? Maybe an once a week supper with liked ones, traveling to new places, or purchasing a leisure activity that gas your creativity. When you identify what matters most, saving ends up being much less concerning limitations and more regarding intentionality.

From there, take into consideration building a flexible budget. One that consists of space for enjoyment and spontaneity. As an example, if you're considering home loans in Riverside, CA, you don't need to consider it as a sacrifice. It can be a step toward creating a life that feels entire, where your area supports your dreams, not simply your monetary objectives.

Saving for the Life You Want-- Not Just the One You're Told to Want

There's no universal plan for economic success. What works for one person go here might not make sense for another. Traditional guidance has a tendency to promote big landmarks: buying a home, striking 6 figures in cost savings, and retiring early. But soft conserving focuses on smaller sized, extra personal success.

Maybe it's having the adaptability to take a mental health day without financial anxiety. Possibly it's saying yes to a spontaneous weekend vacation with your best friends. These moments might not increase your net worth, yet they can enhance your life in ways that numbers can't catch.

As even more people uncover this method, they're also locating that soft conserving can exist together with smart planning. It's not about deserting cost savings objectives-- it's about redefining them. And for those navigating economic choices-- like researching loans in Riverside, CA, the lens shifts. It's no more simply a method to an end, yet part of a way of life that values both protection and enjoyment.

Letting Go of the "All or Nothing" Mindset

One of the largest challenges in personal finance is the propensity to think in extremes. You're either saving every penny or you're failing. You're either paying off all financial obligation or you're behind. Soft saving presents subtlety. It states you can conserve and spend. You can prepare for the future and stay in the here and now.

As an example, lots of people feel overwhelmed when choosing in between travel and paying for a lending. However what happens if you budgeted decently for both? By including happiness, you might actually really feel even more motivated and empowered to stay on track with your financial objectives.

Even choosing which financial institutions to work with can be led by this softer mindset. With numerous banks in California supplying a wide range of products and services, it's no longer nearly rate of interest or charges-- it's also concerning discovering a suitable for your lifestyle and worths.

Soft Saving Is Still Smart Saving

Doubters might say that soft conserving is simply a rebranding of spending extra freely. But that's not the instance. It's a tactical, emotional, and deeply human method to managing cash in such a way that honors your present and your future. It educates you to build a padding without smothering your pleasure. It assists you develop space in your life to prosper, not simply survive.

This doesn't suggest you'll never need to be disciplined or make sacrifices. It just suggests that when you do, you'll know why. Every dollar conserved will certainly have a purpose, and every dollar spent will certainly really feel straightened with what you value many.

Financial wellness isn't a goal. It's a continual procedure of knowing, changing, and expanding. And as you check out just how to take advantage of your resources, soft saving offers a refreshing pointer: your money is a tool, not a test.

For more understandings similar to this, make certain to examine back frequently and comply with along. There's more to discover as you continue forming a life that's monetarily audio and psychologically meeting.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Barret Oliver Then & Now!

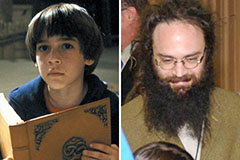

Barret Oliver Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!